Understanding Risk: How to Manage Uncertainty in Investments

Understanding Risk: How to Manage Uncertainty in Investments

What is Risk in Investments?

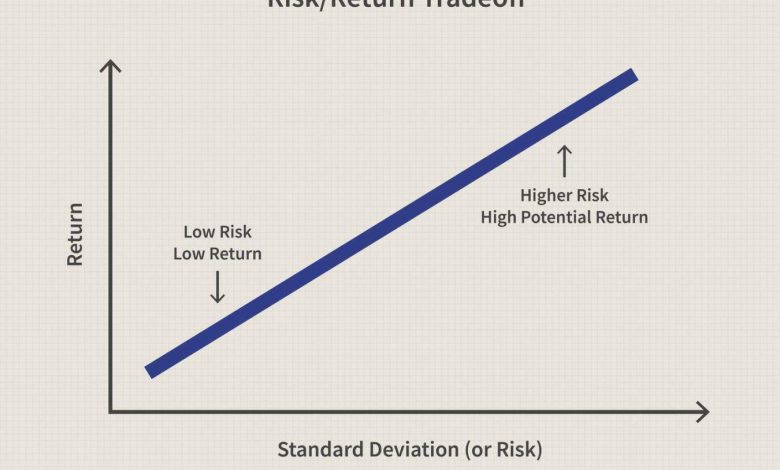

When it comes to investments, risk refers to the potential for losses or negative outcomes. It is an inherent part of investing and cannot be avoided altogether. Understanding and managing risk is crucial for successful and profitable investment strategies.

Types of Risk

Market Risk

Market risk refers to the possibility of financial losses due to fluctuations in the overall market. Factors such as economic conditions, political events, and investor sentiment can all contribute to market risk. It affects all investments to some degree and cannot be eliminated entirely.

Interest Rate Risk

Interest rate risk refers to the potential for losses due to changes in interest rates. Investments such as bonds and fixed-income securities are particularly vulnerable to interest rate risk. When interest rates rise, the value of existing bonds decreases, leading to potential losses for investors.

Credit Risk

Credit risk is the potential for losses due to the failure of a borrower to repay its debts. When investing in bonds or other debt instruments, investors face the risk of defaults by the issuer. Assessing the creditworthiness of borrowers is essential in managing credit risk.

Liquidity Risk

Liquidity risk refers to the difficulty of selling an investment quickly without incurring significant losses. Investments that lack a ready market or are in illiquid markets can be challenging to sell at fair prices. It is important to consider the liquidity risk associated with certain investments before committing to them.

Managing Risk in Investments

Diversification

Diversification is an effective strategy to manage risk. By spreading investments across different asset classes, sectors, and regions, investors can reduce the impact of any single investment’s poor performance. Diversification helps to mitigate the risk associated with market fluctuations and specific events affecting particular investments.

Asset Allocation

Asset allocation refers to the distribution of investments across various asset classes such as stocks, bonds, and cash. A well-balanced portfolio with the appropriate asset allocation can help manage risk. The right mix of assets can create a smoother investment experience and minimize losses during market downturns.

Research and Due Diligence

Thorough research and due diligence are essential in managing investment risk. Understanding the fundamentals of a company, analyzing financial statements, and keeping up with market trends can help investors make informed decisions. Staying informed about the investments in your portfolio can minimize unexpected losses.

Frequently Asked Questions (FAQs)

Q: Can risk be completely eliminated in investments?

A: No, risk cannot be completely eliminated in investments. However, it can be managed and minimized through diversification, asset allocation, and thorough research.

Q: What is the best way to diversify investments?

A: The best way to diversify investments is by spreading them across different asset classes, sectors, and regions. This reduces the impact of poor performance in any single investment.

Q: How often should I review my portfolio to manage risk?

A: It is recommended to review your portfolio regularly, at least once a year or when there are significant economic or market changes. However, the frequency may vary depending on your investment goals and risk tolerance.

Q: How can I assess the creditworthiness of a borrower?

A: Assessing the creditworthiness of a borrower involves analyzing their financial statements, credit ratings, and debt repayment history. Various financial institutions and credit agencies provide credit ratings that can help assess credit risk.

In conclusion, understanding and managing risk is vital in investment success. By diversifying investments, allocating assets strategically, conducting thorough research, and staying informed, investors can minimize potential losses and navigate the uncertainties of the market effectively. Remember, risk cannot be eliminated entirely, but it can be carefully managed to achieve profitable investment outcomes.